Step 6: GET PRE-APPROVED TO BUY A HOUSE IN ARIZONA

Step 6: GET PRE-APPROVED TO BUY A HOUSE IN ARIZONA

Before you start your home search, you should take the time to get pre-approved to buy a house in Arizona.

What is a Pre-Approval?

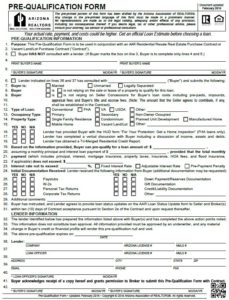

A pre-approval is a written commitment from a lender that says that you qualify for a particular loan type and loan amount based on information that you provide. To obtain a pre-approval letter, you need to contact a mortgage lender. The initial discussion should only last between 15 – 30 minutes and if you provide all of the information that is typically requested, it normally only takes 24 to 48 hours to obtain a signed pre-approval letter. In Arizona, it is quite common for a lender to issue a standard pre-approval letter that has been designed by the Arizona Association of Realtors (AAR) and is called the “Pre-Qualification Form”.Why Should You Get Pre-Approved?

There are many advantages to getting pre-approved and you should do it early in the process of purchasing a home. By the time you receive your pre-approval letter, you should have a good idea what kind of mortgage program is right for you, how price of home you can afford and how much money you need for a down payment.

The top reasons for obtaining a signed pre-approval letter are as follows:

There are many advantages to getting pre-approved and you should do it early in the process of purchasing a home. By the time you receive your pre-approval letter, you should have a good idea what kind of mortgage program is right for you, how price of home you can afford and how much money you need for a down payment.

The top reasons for obtaining a signed pre-approval letter are as follows:

- You will know how much you can borrow. This will help make your home search more efficient. In other words, you won’t waste time looking at homes you can’t afford.

- A pre-approval letter is essential in a competitive real estate market. If you want to make an offer to buy a house, you pretty much must have an accompanying pre-approval letter for the seller to consider your offer.

- You are in a better position to negotiate. The seller will know that you are a serious buyer.

- You save time on closing. Once your offer is accepted, you should be able to close faster because you have already assembled much of the paperwork that is required.

Pre-Qualification – The First Step

Getting pre-qualified is the first step in the mortgage process. It is a pretty simple process that involves providing general information about your financial situation. You can do this in person, over the phone, by email or online. A pre-qualification discussion usually involves the following topics:Income – The lender will want to know the gross monthly income of all people that will be on the loan. He or she should ask a few questions to determine if your income is stable and durable. If a portion of your income is variable (ex. overtime or commissions) the lender may have to determine an average.

Debts – The lender is going to ask you questions about your debts to be able to calculate your debt-to-income ratios (debts divided by total gross income). This calculation is what leads to your maximum qualification amount. You can choose to have the lender pull and review a copy of your credit report for more accuracy.

Assets – The lender will ask you questions about your assets to see if you have enough money for a down payment, closing costs and reserves (money you will have left over after you buy your home). The total amount that you will need also depends on what loan program you choose and other factors.

Where can I get money for my down payment?

If you’re like most people, the down payment on your home is your primary obstacle to buying your home. There are a number of ways to come up with the cash needed to close. Here are a few examples:

Savings – Money that you have put aside and saved.

Gift – In mortgage talk, a gift is money given to you from a friend, relative or employer to help you with your down payment. For it to be a gift, there can be no obligation to pay back the money; otherwise, it is a debt.

Grants and Down Payment Assistance Programs – There are a variety of home buyer assistance programs available in Arizona to help you with your down payment.

Credit – Along with the questions about your debts, the lender should ask you questions about your credit to see if there are any red flags that might keep you from qualifying for a mortgage (ex. recent bankruptcy). As stated above, you can choose to have the lender pull and review a copy of your credit report to see if you have the minimum credit score required to qualify for a loan and to see how well you have handled debt and credit in the past. Typically, the higher your credit score, the better the interest rate that you can receive.

With the information that you have provided, a lender can advise you what loan program options are available and provide an estimate of what your maximum purchase price, loan amount and monthly payment should be. There is typically no cost involved to be pre-qualified and there is no commitment from you or the lender. Also, if your desired monthly payment is less than your maximum prequalified amount, you and/or the lender can calculate what home price and loan amount would result in the payment you want. At this point, the lender should be able to complete lines 1 – 23 on the AAR Pre-Qualification form.Obtain a Signed Pre-Approval Letter

It should be noted that a pre-qualification is not the same as a pre-approval although it is common for the terms to be used interchangeably. Getting pre-qualified is a quick procedure that tells you how much you potentially qualify for based on preliminary information provided. However, it does not carry the same weight as a full pre-approval. Getting pre-approved is more involved. The lender gathers enough information from you to complete a full loan application and requests that you provide supporting documentation that must be reviewed and analyzed. Also, if the lender has not pulled and reviewed your credit report, he or she will do so now. Only after the review of your supporting documents will a signed pre-approval letter is issued. The documents that are commonly requested from you in order to issue a signed pre-approval letter are as follows:- Income verification:

- Pay stubs with year-to-date amounts for the last 30 days.

- W-2 forms for all employment for the previous 2 years.

- Complete copies of previous 2 years personal tax returns including all schedules.

- Asset verification:

- Copy of the past 2 bank months statements (all pages).

Previous Step: MAKE A LIST OF DESIRED HOME FEATURES

Next Step: WORKING WITH AN AGENT AND SEARCHING FOR A HOME

Legal Disclaimer This home buyer series is intended to provide general information regarding the process of how to buy a house in Arizona. It is not intended to provide buyers with legal, accounting or financial advice. You are advised to seek the services of a skilled professional this those fields. Additionally, this home buyer series does not set forth all qualification criteria for any of the loans described herein; all interested persons must successfully meet qualification criteria and complete the application process to obtain such loans.

IMPORTANT MORTGAGE DISCLOSURE

When inquiring about a loan on this site, this is not a loan application. This is not an offer to lend and we are not affiliated with your current mortgage servicer. Upon the completion of your inquiry, we will work hard to assist you with an official loan application and provide loan product eligibility requirements for your individual situation.

When applying for a loan, we commonly require you to provide a valid social security number and submit to a credit check. Consumers who do not have the minimum acceptable credit required are unlikely to be approved. Minimum credit ratings vary according to loan product. In the event that you do not qualify based on the required minimum credit rating, we may or may not introduce you to a credit counseling service or credit improvement company who may or may not be able to assist you with improving your credit for a fee. Any loan product that we may offer you will carry fees or costs including closing costs, origination points, and/or refinancing fees. In many instances, fees or costs can amount to several thousand dollars and can be due upon the origination of the loan product.

This site is in no way affiliated with any news source or government organization and is not a government agency. Not affiliated with HUD, FHA, VA, USDA, FNMA, FHLMC or GNMA. This website and the company that owns it is not responsible for any typographical or photographic errors. If you do not agree to our terms and policies, please exit this site immediately. If you submit your mobile number on this website you agree to receive marketing based text messages. Consent is not required for purchase. You will receive up to 4 messages per month. Standard text and data rates may apply. Reply STOP to stop & HELP for help.

Starboard Financial is an Equal Housing Lender. We do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act.

Contents of this website are copyrighted property of the owner of this website. All trademarks, logos, and service marks (collectively the “Trademarks”) displayed are registered and/or unregistered Trademarks of their respective owners.

Starboard Financial, 4145 E Baseline Rd, Gilbert, AZ 85234

NMLS ID #156931

© 2017 Starboard Financial is not a government agency and is not affiliated with HUD, FHA, VA, USDA, FNMA, FHLMC or GNMA.